Content

This refers to the different types of financial markets you can trade with through LimeFx. Sometimes called securities , they range from commodity futures to stocks and CFDs, to currencies and metals, and more on LimeFx. The LimeFx Micro account starts from a spread of 1.7 pips, this is lowered to 1.2 pips in the Standard account. The LimeFx ECN account carries spreads from 0.4 pips with a commission of $3 per round lot, which outlines a very competitive trading environment.

Traders can also access the free research provided by this broker and receive fresh trading ideas. The most competitive trading environment at LimeFx is located in the ECN account, with spreads as low as 0.4 pips and a commission of $3 per lot. This broker mentions the minimum spread at 0.1 pips in a different section of its website. LimeFx supports the newest iteration of the popular MetaTrader platform, MetaTrader 5 (MT5). MT5 has a built-in economic calendar to keep track of important events in the financial world and live a market depth tracker, which is an excellent way to keep track of other traders’ moves in the market.

Become the trader you want to be with our Next Generation platform technology and personal client service. Learn the basics of spread betting and CFD trading with our introductory videos and guides at the City Index Trading Academy. Develop your skills with easy-to-understand tutorials and master the fundamentals of trading. Harness the power of the world’s most popular FX platform MetaTrader 4 (MT4), now with added asset classes – including commodities and indices. LimeFx designed truly dedicated support to their traders, we found very responsive Customer Service with Live Chat, email and phone support also available in Multiple languages, so is a big plus.

Even though you are a resident of the UK for example

your account may fall under regulatory rules outside the jurisdiction of the FCA. Check which company

entity and regulation your LimeFx account is over seen by. LimeFx client funds are stored in segregated 3rd party bank account in accordance limefx website with LimeFx financial regulators. Leading brokerages like LimeFx offer mobile trading apps to their clients who are able to use them to trade and even monitor their entire LimeFx portfolio. All an investor needs is a Web-enabled smartphone and a trading account with LimeFx.

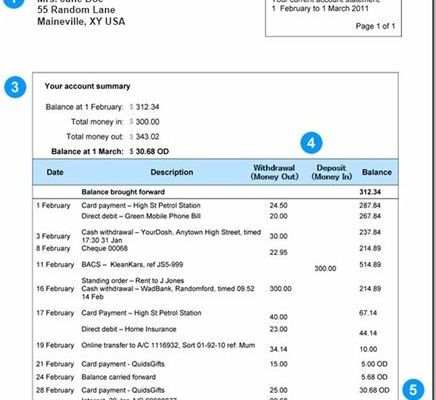

LimeFx Withdrawal Fees

Also unfortunately, the supported trading platforms come as a basic version only, as LimeFx doesn’t offer any required third-party plugins. This leaves traders without critical features and requires further LimeFx to upgrade the trading environment. The Pro and ECN Accounts have spreads starting at 0.3 pips on the EUR/USD, with a round turn commission of 3.2 USD, making them some of the lowest-cost accounts in the industry. However, this is in exchange for a minimum deposit of 500 USD, which is relatively high. LimeFx offers a standard trading account, allowing LimeFx traders to trade a wide range of financial instruments, with competitive spreads, using the feature rich LimeFx trading platform. The majority of LimeFx trading fees, commission is either a flat fee per trade or calculated based on the number of traded shares.

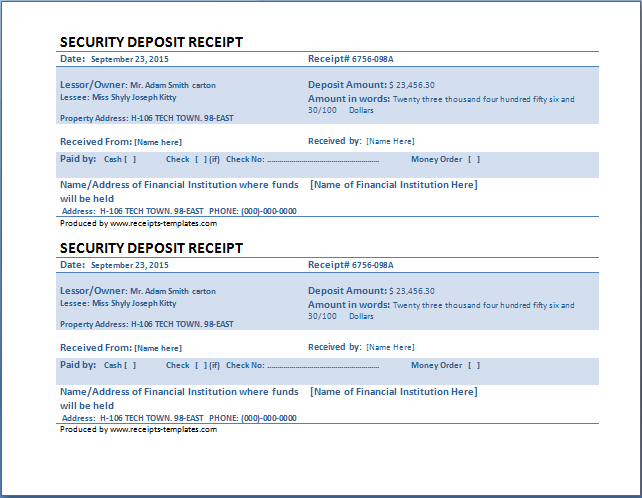

Enter your details, upload proof of ID,

fund your account and you should be up and trading within a few hours. LimeFx live chat support is a way for customers to obtain help from LimeFx through

an instant messaging platform. It can be a proactive chat pop-up, with a chat box appearing https://limefx.biz/ on the screen and asking if you need help. Livechat is great if you require a reponse to your support request withing 15 minutes. Customer support represents the resources within the LimeFx company that provides technical

assistance to its customers after they use the LimeFx service.

How Forex PAMM Accounts Work – Investopedia

How Forex PAMM Accounts Work.

Posted: Wed, 07 Sep 2022 07:00:00 GMT [source]

MT5 also has a built-in news feed and an economic calendar, and trades can be made on a chart. However, for traders that trade in large volumes (more than 10 lots a month), it is better to open an account denominated in USD, especially for trading on assets such as the EUR/USD. This is because when trading a USD quoted currency pair with another currency account, there will be a small conversion fee for every trade made. LimeFx’s Nano Account has no minimum deposit requirement and allows trading in smaller trade volumes (micro-lots) making it accessible to beginner traders. LimeFx’s accounts are suitable for beginners and more experienced traders.

Choose from 8 Accounts & 9 Platforms What Meets Your Needs with HotForex

MetaTrader 5 is a multi-asset platform suitable for trading in the Stocks and Futures markets too. It is a multi-asset platform that allows trading Forex, stocks and futures, and it also offers superior tools for comprehensive price analysis. As ownership is typically involved, many independent spot forex brokers impose taxes on earnings. Forex spread betting does not involve a physical purchase, thus traders do not need to pay stamp duty or capital gains tax with a forex spread betting account.

- LimeFx provides traders with the MT4 and MT5 trading platforms, but only the basic version.

- ETF shares, like individual stocks, are traded throughout the day at varying prices based on supply and demand.

- Besides its focus on PAMM accounts, it also advances social trading via its LimeFx CopyTrade platform.

- No underlying assets are exchanged with a LimeFx CFD contract,

it is purely speculation on the crypto financial instruments price movements with LimeFx. - CFDs can be used to trade a variety of underlying assets, including stocks, commodities, and foreign exchange.

To bring transparency to the forefront, we have published our review process that includes a detailed breakdown of the LimeFx offering. Central to that process is the evaluation of the reliability of the broker, the platform offering of the broker and the trading conditions offered to clients, which are summarised in this review. Each one of these is graded, and an overall score is calculated and assigned to the broker. LimeFx’s MT4 and MT5 apps allow traders to work from anywhere, with nine timeframes, 30 indicators, and interactive currency charts. Functionality to close and modify existing orders, calculate profit/loss in real-time, and tick chart trading further empowers traders while on the move. Opening a trading account at LimeFx is a fully digital process and is hassle-free compared to other brokers.

How does spread betting work?

LimeFx offers six live accounts, which is more than most other brokers, and its accounts are suitable for beginners and more experienced traders. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Trading videos on LimeFx help new and limefx scammers even more experienced investors gain insights into LimeFx technical analysis tools and

how the different financial markets work when trading on LimeFx. Taking advantage of LimeFx trading research tools which are designed to help traders analyse potential LimeFxs using the LimeFx trading platform. Some LimeFx research tools include charts, technical analysis, and LimeFx trading indicators.

A customer may often need to seek out support when they are in need of help, so a customer support team must be easy

to contact, available, and responsive. You may be charged a currency conversion fee by your withdrawal method if you withdraw your LimeFx account balance in a currency other than GBP,

or whatever your withdrawal method account base currency is. A LimeFx payment method is required to fund your LimeFx trading account before placing a buy or sell order on a financial instrument. Commodity trading is a type of trading available on LimeFx where individuals or businesses buy and sell financial instruments using LimeFx related to commodities, such as metals or oil. A LimeFx stop-limit order is an order to buy or sell a stock that combines the features of a stop order and a limit order. Once the stop price is reached, a stop-limit order becomes a limit order that will be executed at a specified price (or better).

LimeFx Trading ETFs

Saving 0.5 percent might not seem like much, but if you often trade stocks for the short term, it’s a huge amount. As opposed to the actual purchasing and selling of assets, spread betting makes use of bets. If you were to buy Apple stock, for example, you would hold it for a while before selling it. In spread betting, you might get the same result by betting on an increase in the price of Apple’s stock. Ignoring it as a factor in spread betting’s appeal would be naive, as the promise of enormous returns is an important part of spread betting’s allure.

The most competitive trading environment is provided in the ECN account, where traders can operate with a minimum deposit of just $500 for a starting spread of 0.4 pips and with a commission of only $3 per lot. This marks one of the most trader-friendly cost structures in today’s brokerage industry. With a range of accounts on the MT4 and MT5 platforms, LimeFx caters well to professional traders who are prepared to pay high minimum deposits for low ongoing trading costs. However, LimeFx offers a limited number of tradable assets, which may leave some traders dissatisfied.

Top 10 Best Forex Brokers for Spread Betting

Investors can also transfer funds into their LimeFx trading accounts from an existing

bank account or send the funds through a wire transfer or online check. Spread betting enables investors to bet on whether the price of an asset will increase or decrease with added benefits, including exemption of income tax, capital gains tax and stamp duty. Traders will commence spread betting from £0.10 per point, for which they have to open a spread betting account with the firm. Traders can also benefit from the firm’s research tools to make better-informed trading decisions. Global foreign exchange (FX) brokerLimeFx (U.K.)is launching spread betting on trading platformMetaTrader 4. Traders can also backtest, optimize and trade their Expert Advisor strategies on the platform to spread bet FX.

12 Best Crypto Trading Bots for July 2023 – CryptoNewsZ

12 Best Crypto Trading Bots for July 2023.

Posted: Tue, 11 Jul 2023 07:00:00 GMT [source]

There are numerous instruments available for trading with quite good conditions with our opinion, this including Binary Options, also education is good. Research and analysis section is just great, LimeFx is good for beginning traders, also provides automatic trading and participates in various projects. LimeFx offers a micro account from just $5 or a currency equivalent, while the standard one requires $100. LimeFx recommends a minimum deposit of $1,000 but allows transactions as low as $100.

LimeFx features 60 Forex pairs and 33 CFDs across commodities, equities, indices, and cryptocurrencies, as listed under contract specifications. LimeFx offers 70 currency pairs and 185 CFDs covering the same as LimeFx minus cryptocurrencies. Therefore, the known asset selection is superior but remains well below many competitors at both brokers. In this Forex broker comparison, we’ll be taking a look at LimeFx, a Mauritius-based Forex broker, and LimeFx, a broker that operates both in the United States and across the globe. Both brokerages accumulated over twenty years of market experience and have become household names in the Forex industry, but are on decidedly different paths.

The LimeFx MT4 Open Order feature shows market sentiment based on this broker’s order book. Developers are supported via a series of LimeFx APIs, allowing for the development of customized trading solutions. PAMM accounts remain at the core of LimeFx with over 56,000 PAMM accounts and 550,000 traders. Social trading is additionally supported through the LimeFx CopyTrade platform.

If you want to withdraw more than you have available as cash, you may need to close open LimeFx positions before doing so. Remember that after you close your orders, you may have wait for the trade to settle before you can withdraw that money from your LimeFx account. Withdrawals fees vary between LimeFx and LimeFx alternatives depending on where you are located and how much money you are withdrawing. Since spread betting is a form of gambling, profits are not taxed at all. You won’t have to include any information about trading on your annual tax return, which is another benefit. You can trade many times each day or open a small number of spread betting positions each quarter; the choice is yours.