Content

Please, get in touch with us to find out how we can help you with your payroll needs. The accounting service cost in London can be pretty expensive for small businesses or organisations with low annual turnover. However, these services can help your company grow and increase turnover, solving tax complications and other financial issues in the company. The monthly cost of these services for a small business can be as low as £60 to a maximum of £250. If you are looking for an accounting firm, ask them the price for a standard core package and additional charges for extra services. There is a misconception among small business owners that hiring an accountant is a luxury, and they can’t afford to hire one.

Allow AccountantCosts to be your one-stop-shop for your bookkeeping and accounting needs. We can support your business growth by improving your company’s cash flow and bottom line via our bookkeeping expertise. More experienced professionals charge higher than newbies and mid-level professionals. This is usually as a result of the expertise they have been able to build over time. If you can afford to, get the services of a well-experienced bookkeeper. Bookkeeping is one of the primary practices every successful business and conglomerate has at their core.

Positives of Owning a Bookkeeping Business

To book a virtual training or consultancy session follow the link below. You can also use this link for an initial chat to plan and discuss your requirements. Our experts will work with you to reduce your corporation, personal or any other tax liability, all within the rules of the UK tax legislations. We’ll ensure you’re claiming all allowances and expense claims that you would be elegible for. Under ideal conditions, it should be done every day as part of every business’ daily operations.

- Whatever your circumstances may be, we can help simplify your bookkeeping, file your tax return or manage payroll on your behalf.

- Giving vital details around income and expenditure and highlighting areas that may need to be streamlined.

- The vast number of documents will likely require you to invest in secure cloud storage.

- Your records may be inspected, and you could face legal measures if they are not correct.

- An accountant may charge you between £150 to £250 or more for an annual self-assessment tax return.

You will be assigned a dedicated bookkeeper whose role it is to give you great service. They will then liaise with your accountant at the end of the year to make the whole accounts production process seamless. As a business owner, it’s important that you understand what is going on in your business, and whether all your efforts are actually making you money. Fixed cost is good for cost control, however if your business gets smaller (for instance if it’s a low season), the level of work will drop, but the price stay the same.

Our Remote accounting services

Bookkeepers are needed all over the world and many other countries place value on bookkeepers who have knowledge of the UK and US financial markets. You could move abroad and run your business from another country or even move your business to another part of the UK. This is a great advantage for people who may want to travel or don’t yet know where they want to base themselves. It is a legal requirement that you maintain all your bookkeeping records and proofs of transactions for six years. Your records may be inspected, and you could face legal measures if they are not correct. You must apply for an Anti-Money Laundering Licence at least 45 days before your business begins operating.

What is a full charge bookkeeper?

What is a Full Charge Bookkeeper? A full-charge bookkeeper is the same as a bookkeeper, except that the "full charge" part of the title designates the person as being solely responsible for accounting.

Smooth Accounting is very proud to be supporting the amazing work of JUST ONE Tree, a non-profit reforestation initiative. We charge £600 + VAT for the tax return if you have one property and an additional £100 + VAT per additional rental property. Whereas a company having bookkeeping for startups turnover between £100,000 and £200,000 will pay a monthly charge of circa £150, and £200 for turnover between £200,000 to £400,000. In order to avoid this phenomenon, we strongly encourage to Identify or create an incentive for the team – something that they can relate to.

Per Job

Bookkeeping is the process of recording the money coming in and out, so that you can see exactly what is happening in your business. Our offices are situated in the East Midlands, but we’re able to service clients on both a local and national level. Our team works hard to take the hassle out of accounting, and it’s that same commitment that helps us provide you with the right solutions. Financial resources are the backbone of every business, and the way in which they’re managed can make or break commercial success.

How much should a bookkeeper charge per hour UK?

The part-time bookkeeping rate charged by bookkeepers varies according to location and job scope. Most part-time bookkeepers charge an average rate of around £20 per hour for performing general bookkeeping duties and their job functions are usually overseen by the company hierarchy.

Owning your own bookkeeping business also means that all your profits will belong to you, and you will be in control of creating your ideal business. Any person or business who is involved in the preparation of financial reports must comply with the regulations regarding how reporting is done. The Financial Reporting Standards ensure that companies maintain their credibility and report their finances in an honest and transparent manner. Rather than dealing with paper receipts or clients that can’t find physical copies, digital receipts allow you to keep electronic copies and store them safely. You can send clients their receipts via email and receive receipts from their outgoings and invoices. This can help to save you time when trying to calculate your clients’ expenses and balancing their books.

Any person who provides bookkeeping services must ensure their complicity with these regulations. You will need to be monitored by an HM Treasury appointed supervisory authority, such as the Institute of Certified Bookkeepers (ICB). Your business must also put controls into place to help you identify and prevent money laundering. If you run your business remotely, you will need to ensure your Wi-Fi is reliable and high speed. You will likely be using the internet for much of the day and will need to ensure it doesn’t cut out in the middle of a meeting. Contact the available providers in your area and ask for an approximate speed per second for uploads and downloads.

There is no reason that your accountant cannot provide both services, unless they don’t have the skills to do so. The Freedom in Numbers team are always on hand to provide support suited to your business, including advice on getting the most out of your finances. Furthermore, enlisting a bookkeeper on a flexible basis will enable you to only pay for what you need. By entrusting your bookkeeping to a recognised https://www.vizaca.com/bookkeeping-for-startups-financial-planning-to-push-your-business/ expert, you’ll also be able to rest assured that crucial administration will be carried out in the most diligent and efficient way possible. Outsourcing your bookkeeping can be financially attractive for several reasons. To begin with, doing so will help you free up valuable time currently spent completing these tasks for yourself, allowing you to focus your attention on more lucrative opportunities.

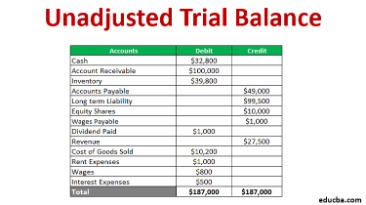

Then when it comes to doing the Annual Accounts and tax the whole process will be seamless as we have already collected most if not all the information that we need. A trial balance is a bookkeeping worksheet in which the balances of all ledgers are compiled into debit and credit columns. You need to be comfortable with charging different clients different amounts, and you need to expect to have a conversation with each prospect before they become a client. At Freedom in Numbers, we’re here to support your business, and take away the stress of the administrative side of business, giving you your freedom back. Time based doesn’t always encourage efficiency, as the amount someone is paid goes down if they use automation to speed up the process.