Between the sell and buy side, we find the current market price, called the mid-market price, or last price. Trading is not just about trying to predict the price of an asset, it requires knowing how to use tools such as exchanges and take advantage of all their services. Understanding how market makers work, advanced orders and how the order book works is fundamental to mastering an exchange and knowing how to choose one. In most practical applications, an order book contains bid and offer for one security, contract or good, with a specialist matching orders for the specific item.

If you want to become an expert crypto trader and make excellent trades with little to no losses, then you’ve got to know how an order book works. The order book official keeps track of these orders for an assigned group of options and makes sure the market remains fluid and fair. A floor broker is a middleman acting as an agent for clients, indirectly giving them the best access possible to the exchange floor. The OBO is also responsible for maintaining a book of limit and stop orders left for him /her by the public. When the order’s specific conditions are met, that order is then executed. For example, say that you buy a share of Google (GOOGL) for $1,000 and set a trailing-stop up at 10%.

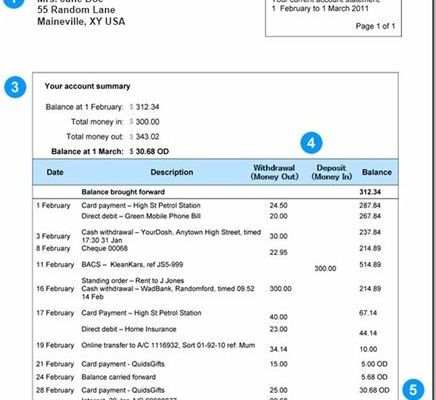

This information gives you a good idea of the interest in that security, the sentiment of investors, and the overall market depth of how that security is trading. You can use this info to supplement your analysis and determine whether you should invest in this particular security, or take a long or short position. An order book lists all the open orders with different offers from buyers and sellers for an underlying security. For instance, a massive imbalance of buy orders versus sell orders may indicate a move higher in the stock due to buying pressure. Traders can also use the order book to help pinpoint a stock’s potential support and resistance levels. A cluster of large buy orders at a specific price may indicate a level of support, while an abundance of sell orders at or near one price may suggest an area of resistance.

- The order book official keeps track of these orders for an assigned group of options and makes sure the market remains fluid and fair.

- If there is a huge sell order that can not be filled because demand is too low, then sell orders with lower asks will not be executed.

- You can see at which price asset A is traded for asset B for each individual trade on the order book.

- The “Price” column lists the price at which the two assets involved are changing hands.

Keep in mind that the sell side of the order book will list all asks above the last traded price. Like with buy orders, an abundance of sell orders at a particular price could also form a wall, known as a sell wall. It is easy to locate the buy side of an order book because it is usually in green. Bids are located on the buy side of the order book, which is a list of all pending buy orders. You want to keep in mind that the open orders you find on the buy side will all be orders below the last traded price. Any offer from a buyer is known as a “bid.” You definitely recognize that from everyday lingo.

Observing Price Movements

On the other hand, if a market is illiquid, large investors can easily manipulate it using order books. For instance, if a whale wants to sell its holdings at a higher price, it can place a buy order above the current price and record the order in its order book. This encourages other traders to buy assets because they believe the price will increase. In this case, if the traders’ belief is realized, the price starts to rise. The order book is a cornerstone of modern trading and investing, providing essential real-time information on market depth and the array of buy and sell orders at various price levels. Understanding how to interpret and use order book data can give traders a significant advantage in navigating the market.

Ultimately, this will crash the price of the asset and leave small traders in the dumps. Market makers (MMs) post and maintain continuous two-sided markets, i.e., bids and offers, for a given options contract and trade for their own accounts. MMs also cannot deal directly with the public, and must wait for orders to come into the floor via broker or exchange official.

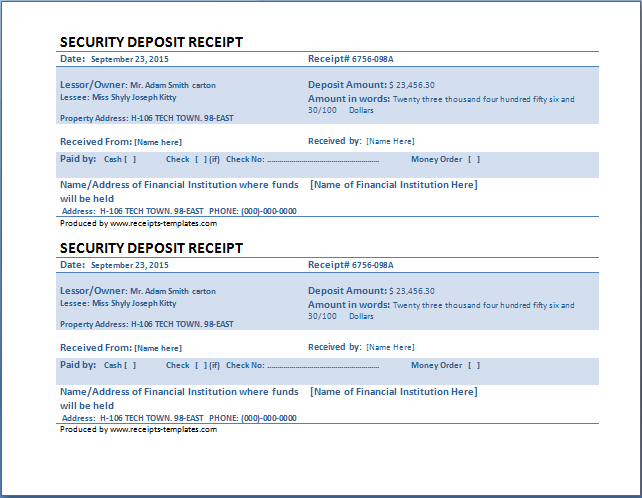

Access Exclusive Templates

Understanding the order book can give you an edge on when and at what price you should enter the market for a specified investment. It can reveal both the depth of trades behind a security and pre-market information, giving you indications of the best price to enter the market. For every security traded, there is a buyer and a seller, and a “bid” and “ask” price. The price at which the buyer is willing to pay for a security is the bid, and the price at which the seller is asking for the security is the ask.

Book depth

An order book is an electronic or written list of all the buy and sell orders investors have made for a particular security. It lists the prices buyers and sellers are willing to pay, and how many orders are submitted for the particular price. Investors use order books for technical analysis of potential investments. For example, knowing the prices and the volume of orders behind those prices can indicate which direction or trend the underlying security may move. The “Total” column shows how much a trade was worth in terms of asset B.

What Exactly Is Presale, And What Kinds Of Presales Are Used In The Crypto Industry?

As we have already seen, any buy order will remain on the order book until there’s a sell order that matches that bid or the buyer gives up and cancels the order altogether. For instance, say you want to buy some bitcoin, and the best you’re willing to pay is $16,000. So, you set a limit order on your preferred exchange to buy bitcoin at $16,000, and the order book takes note of it under the buy section. Order books are publicly accessible, so everyone on an exchange has access to all the order books at any time. The good thing, however, is that once it’s understood, it makes all the sense in the world and becomes an indispensable tool for profitable trades. Read on as we explain the basic concepts surrounding the operation of an order book and its importance in the crypto space.

Seasoned copywriter with a focused expertise in crypto and fintech, adept at translating complex industry jargon into clear, engaging content. Driven by my mission to illuminate the intricacies of the crypto and fintech industries, my commitment is to create and deliver content that educates, engages, and empowers. I strive to foster understanding, inspire confidence, and catalyze growth in these dynamic sectors, contributing to the forward momentum of our digital financial future.

Unlike other exchanges, like a stock exchange, the CBOE divides the designated market maker (specialist) role into two separate functions. A market maker, who acts as a dealer with his /her own inventory, and an order book official, who handles the book of customer limit orders. The term is sometimes used in reference to a current list of public market or limit orders for a given exchange. For example, a list of specific public orders awaiting execution on the Chicago Board Options Exchange (CBOE) could be referred to as the “order book official”. Large orders often come from institutional traders and can significantly impact the price. If a big order is filled, it could trigger a surge in trading volume and lead to substantial price shifts.

But once you get the hang of four fundamental concepts, you’ll be able to read any order book, regardless of what exchange it’s on. Meanwhile, other people are also placing limit orders to sell their bitcoin, which you’ll find under the sell section of the order book. This is because limit orders are being created, completed, and canceled all the time. And as each of these activities take place on an exchange, the information on the order book will change. It essentially says that I am willing to buy or sell at this price, no higher, no lower.

Order books give a trader in-depth insight into the market which enables better trades. Here is a quick rundown of some insights you can gain from an order book. You can place a sell limit order or you can just take the best bid you find on the buy side by placing a market order. Let’s say you are looking to buy some bitcoin using USD, you can do that one of two ways. You could place a buy-limit order or you could just take the best ask on the order book by placing what is called a market order. The second option is much faster, as you might be able to tell, whereas the first option, that is, placing a buy limit order, could take an indefinite amount of time.

Support

A gap on the sell-side may mean there’s less resistance to upward price movement, which could be a bullish signal. Conversely, a gap on the buy-side could mean lower support, suggesting potential downward momentum. As a result, order books acciones gamestop are important as they allow market participants to better understand and evaluate market movements and potential trading opportunities. The buy side is located in the lower section of the book and all entries are coloured green.

Order books can give a clear indication as to whether the bulls or bears are in charge of a market. For example, if there is an abundance of sell orders compared to buy orders, it could be taken as an indication that the market is due to decline amid selling pressure. Do not get https://bigbostrade.com/ frustrated if you do not seem to get the hang of using order books immediately. So, the key to being adept at interpreting and using order books is patience and practice. Once you get the hang of it, you will find that it’s an invaluable tool for your crypto trading venture.