Contents:

You could wait for that to break out – that resistance level. That could happen from time to time as you recognize the whole situation with two peaks. And if that’s a difficult level to break through and if we continue moving lower and we break below that support level that could be a longer-term downtrend. That can be a place where I may want to hold off on the stock. Anytime you’re getting these selling off movements , you’d like to see a little bit of higher volume in that spot. Especially as you get into the break, and if you’re looking to enter on that position one of the entry points could be just after it breaks that support.

In its purest form the consolidation pattern represents a frozen market where the ongoing trade activity is netted out, that is, buyers and sellers are in complete equilibrium. Such a situation is very rare in the markets, and of course it cannot be maintained indefinitely. When the pattern breaks down, the ensuing price movement is rapid, with volatility, and volume increasing in harmony.

Russian figure skating coach produces champions with propensity for injury, short careers – 9News.com KUSA

Russian figure skating coach produces champions with propensity for injury, short careers.

Posted: Sat, 12 Feb 2022 08:00:00 GMT [source]

Not only does the breakout eliminate a previous range pattern, as seen on the lower part of the chart, but once the sharp movements of the breakout die out, the resulting formation is another range pattern too. You can try to draw the support and resistance lines on the chart visually, if you like, as a kind of exercise. Thus, in this case, the price has been leaping from one range to another, consolidating before going on with its movement.

Pattern Cluster

With all head and shoulder patterns, the moment of potential reversal is when the price breaks through the baseline. In the case above, the head and shoulders pattern had completely formed by late November 1998. When the price broke below the baseline at the end of November, it was an extremely bearish sign, and the price subsequently broke down. There can be double, triple, even quadruple top/bottom patterns. The more tops or bottoms that form, the stronger the pattern is.

Observe the constricted price action just before the double top pattern. The tight trading range is also known as a Bollinger Squeeze. Hence, the double top was also part of a failed breakout from the Bollinger Squeeze.

Trading the Double Top and Triple Top Reversal Chart Patterns

https://forexaggregator.com/ selling occurs when an investor borrows a security, sells it on the open market, and expects to buy it back later for less money. Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism. She has worked in multiple cities covering breaking news, politics, education, and more.

Connect the two retracement lows with a trendline and extend the line out to the right. You’ve learned 4 techniques to trade the Triple Top chart pattern. 1.When a pullback occurs, it gives you a logical level to set your stop loss. For example, your stop loss can go above the highs of the pullback .

In general, the conservative trader would have exited the trend a short while after the development of the parabolic pattern. Enough profits have been made, and as the trend keeps spiking, invalidating the signals generated by most technical tools, there’s little point in engaging in a dangerous speculative game. Identifying bubbles is not easy with technical tools alone, but we will confine our discussion to technical approaches in this text. The ascending triangle is a bullish formation that usually forms during an uptrend. This line represents overhead supply that prevents the security from moving past a certain level.

Fakey Trading Strategy (Inside Bar False Break Out)

Her expertise is in personal finance and investing, and real estate. Just like the beanie pattern, this crochet cowl pattern incorporates several rows of the Quadruple Treble Crochet, which is a very tall stitch. It took me a long time to master this stitch, but it is a fun way to add some unique texture to a project. Many of my testers for this crochet cowl pattern said they enjoyed using the stitch. You can find a great tutorial for various “tall stitches” over atMooglyblog.com, as well as photo instructions for the quadruple treble in the pattern below.

- Short selling occurs when an investor borrows a security, sells it on the open market, and expects to buy it back later for less money.

- You created one peak there, and we’ll draw a line across, and you can see we created a second peak a little later.

- The asset will eventually reverse out of the handle and continue with the overall bullish trend.

- If the prior trend was an uptrend, the most likely direction will be up; if the prior trend was a downtrend, the most likely direction will be down.

- Instead, attention is directed to the market-moving data and the aim is to maximize profits, as soon as the other market’s expectations are confirmed by the developments.

While it is sometimes difficult to distinguish between reversal patterns and continuation patterns, the Triple Top Breakout itself is easy to identify. The most basic P&F buy signal is a Double Top Breakout, which occurs when an X-Column breaks above the high of the prior X-Column. From this basic pattern, the bullish breakout patterns become more complex and wider. The wider the pattern, the better established the resistance level and the more important the breakout. This article will look at the five key breakout patterns in detail and show measuring techniques for Price Objectives. A rounding top is a chart pattern used in technical analysis which is identified by price movements that, when graphed, form the shape of an upside-down “U.”

Double Inside Bar Pattern For Intraday Trading

Of course, aggressive https://trading-market.org/rs who are particularly bearish on the stock may not wait for the downside break at $12.50 to short it. They may enter into the short sale after the stock has failed to break through $15 for the third time, rather than wait for confirmation of the sell signal on the downside break at $12.50. Quickly review screen captured stock charts with annotations.

As continuation patterns, pennants are similar to flags and other triangle patterns. But they differ in their brief duration, and the lack of consolidation during their development. In fact it is possible to consider the pennant as a straight horizontal line where the traders briefly mark the time, rather than doing anything that can influence the direction of trading. Once identified, it is fairly easy to trade the flag pattern.

This was expected to a certain degree, given how explosive the breakout was. As outlined earlier, the triple bottom is a bullish reversal chart pattern. Hence, we are looking for clues when the market is ready to reverse its course. The signal that we are looking for is a break of the neckline.

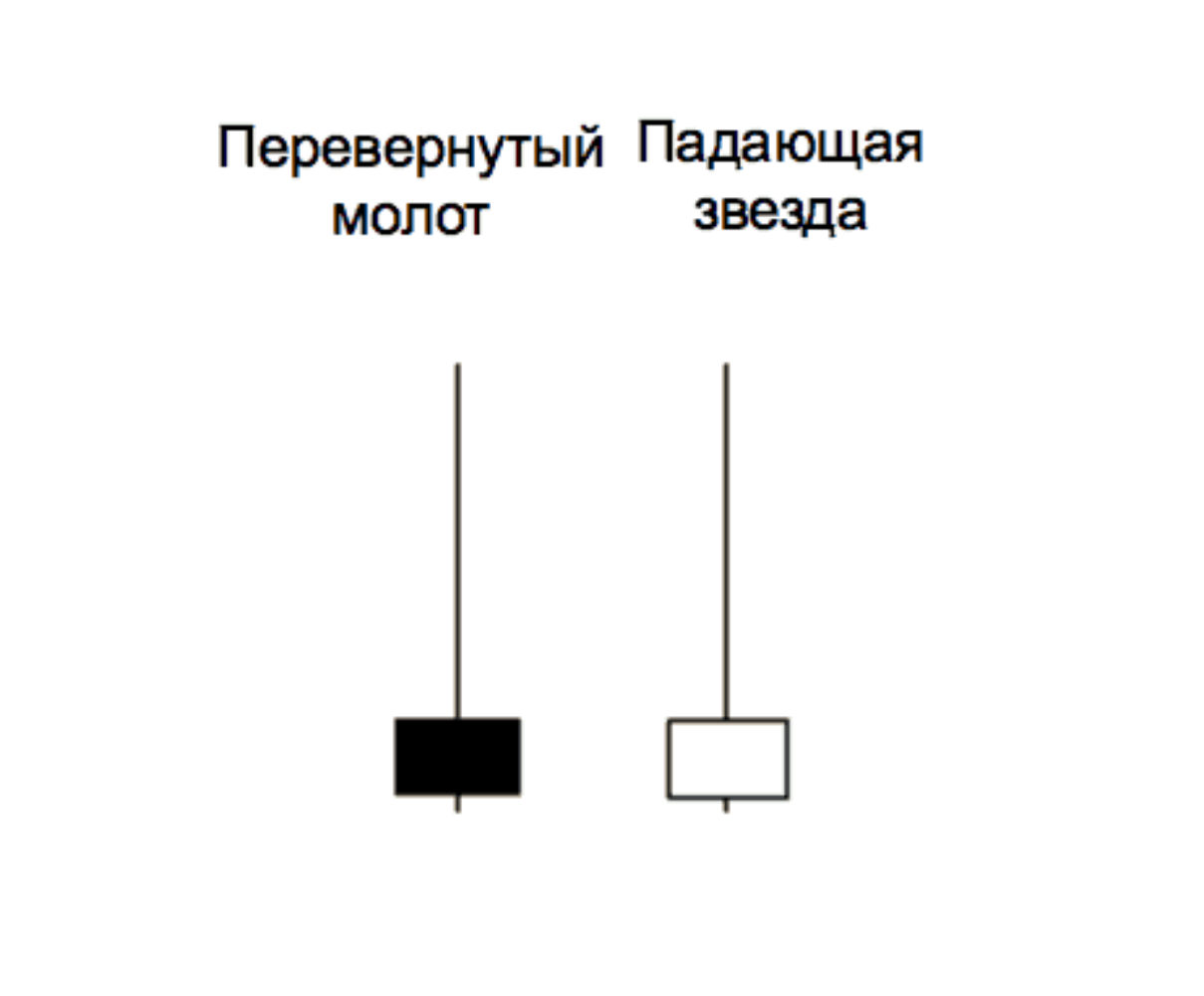

No matter your experience level, download our free trading guides and develop your skills. Entering a long position as the market closed above the Bollinger Band led to a fantastic trade. But this bullish thrust managed to close above the Bollinger Band. This stark difference confirmed that the market tide had turned bullish. You’ll find the candlestick chart helpful for picking your exact entry point.

https://forexarena.net/ Top Breakouts are five columns wide (3 X-Columns and 2 O-Columns), Quadruple Top Breakouts are seven columns wide and Spread Triple Top Breakouts are seven columns minimum. Notably, multiple tops do not have to be formed at the exact same price. Chartists consider acceptable multiple tops formed at price points as much as 3% apart. Multiple tops occur when the security hits this high in roughly the same area several times a day or weeks apart.

Multiple patterning (or multi-patterning) is a class of technologies for manufacturing integrated circuits , developed for photolithography to enhance the feature density. It is expected to be necessary for the 10 nm and 7 nm node semiconductor processes and beyond. The premise is that a single lithographic exposure may not be enough to provide sufficient resolution. Hence additional exposures would be needed, or else positioning patterns using etched feature sidewalls would be necessary.

- This line, when extended out to the right, is useful for trading and analyzing the double topping market.

- If it was weak volume, you might see it digest and move higher.

- The pattern contains at least two lower highs and two higher lows.

- It is also likely more than one cut would be needed, even for EUV.

- Now that we know what a support and resistance line are, we can discuss the ranges formed by the price fluctuating between two such levels.

They almost always need to establish some kind of base first, and the form this base takes varies from stock to stock. Inside bars work best on the daily chart time frame, primarily because on lower time frames there are just too many inside bars and many of them are meaningless and lead to false breaks. In the chart above, we see USD/JPY on a daily chart that is moving lower. The bears then register three attempts to break below the horizontal support around the $108.50 mark, however without much success at all. If you look more closely, you will count at least 8 touches of the $108.50 handle, while we highlighted three lowest prints on a chart. If you look at the illustration above, the blue line represents the horizontal support that rejected the bears’ attempt to extend the downtrend.

That being said, it is important to know the ‘best’ chart pattern for your particular market, as using the wrong one or not knowing which one to use may cause you to miss out on an opportunity to profit. When minimum pitch is reduced to 32 nm or less, stochastic defects are prevalent enough to reconsider double patterning at larger design widths. Below 40 nm pitch, EUV is expected to require multipatterning due to the necessity of maintaining sufficiently small distance between line ends, without destroying portions of lines in between. The number of masks required can match that of DUV, such as for this target pattern. Self-aligned quadruple patterning is already the established process to be used for patterning fins for 7 nm and 5 nm FinFETs.