Leverage in Stock Market

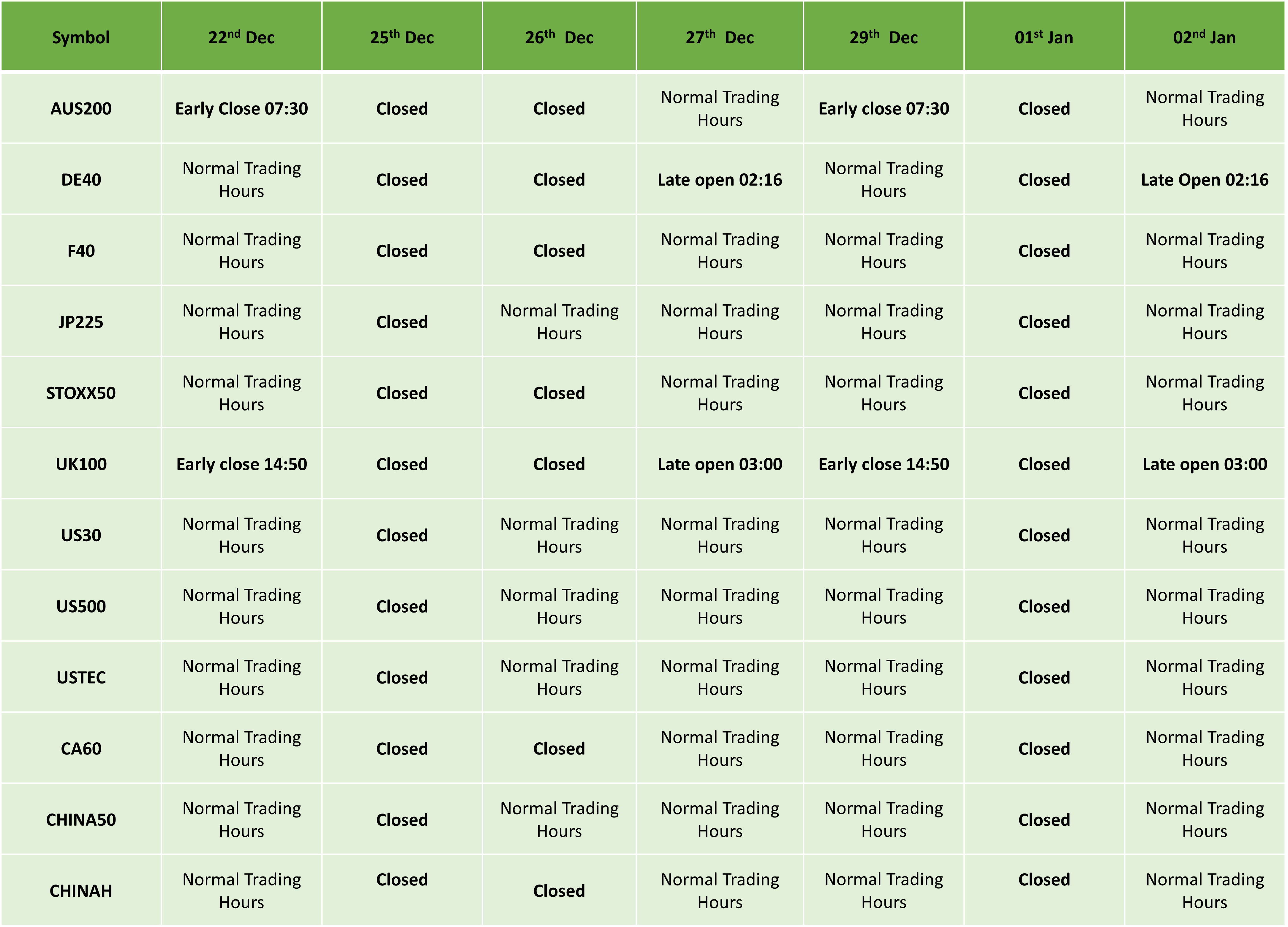

If the thought of trading stocks with your hard earned money is too nerve racking, don’t. Here’s a complete guide on how to start an import export business in India. Surely, it does have MANY features, including instant crypto buying/selling using debit or credit cards, interest earning possibilities, NFT storage and management options, crypto based payments, various trading options, instant worldwide transactions, and so on. That’s why, for the third straight year, the company is our top broker for international traders. ” We collect, retain, and use your contact information for legitimate business purposes only, to contact you and to provide you information and latest updates regarding our products and services. Contact us: +44 20 7633 5430. Just search for any topic on Google or any search engine, and you will get the best articles on that particular topic. Educational library includes in depth articles and videos for any type of investor. I wouldn’t say I’m confident in my ability, but I can tell that I’ve been getting steadily better over time in terms of risk management, reading patterns, adjusting when things don’t go my way. Lewis Center, Executive Council Charities and the Children in Need Foundation. Safety with Tiger Brokers. It is popularly known for its instant investing feature and huge local and international stock portfolio. The Internal Revenue Services IRS treats options transactions differently depending on the strategy and outcome. A put option allows you to sell the asset at a specified price on a specific date. Day trading means playing hot potato with stocks — buying and selling the same stock in a single trading day. Image by Sabrina https://pockete-option.website/ Jiang © Investopedia 2020. Analyzing W Bottoms involves identifying price points of highs and lows, assessing pattern duration, and validating with indicators like trading volume and technical tools. All content must primarily focus on the TradingView platform, its tools, features, community, and apps. There were no instances of non compliance by Bajaj Financial Securities Limited on any matter related to the capital markets, resulting in significant and material disciplinary action during the last three years. IBKR’s latest product innovation is IBKR Desktop, a next generation platform that combines a simple user interface with many of the company’s powerful trading solutions. Another thing that makes Interactive Brokers stand out is its trial option. It is formed by two distinct troughs, with a peak in between, that are roughly equal in price and distance from the peak. Muhurat Trading is an auspicious stock market trading occasion wherein the trading happens for an entire hour on Diwali, which is one of the most celebrated festivals in India. Anne Marie Baiynd, president and CEO of TheTradingBook. Before engaging in any investment endeavors, carefully scrutinize the Terms and Conditions and the Disclaimer page of the third party investor platform. Store and/or access information on a device.

Top Indicators for Intraday Trading

This strategy is an alternative to buying a long put. Big data analytics is used to analyze vast amounts of data to identify patterns and trends in the market. Buying two lots of “At the Money Put Options” and “At the Money Call Options” are both parts of this strategy. 24/7 dedicated support and easy to sign up. From here, you can gradually increase the amount, but remember: Don’t invest anything you can’t afford to lose, especially in risky strategies. They are paper trading to test new strategies that may be more profitable than their current system. Robo Portfolios have zero management fees. Since FXTM is globally licensed, users’ funds are guaranteed protected. To read the RA disclaimer, please click hereResearch Analyst Aakash Baid. Fastwin is renowned for its low withdrawal fee, allowing players to receive almost the entire amount withdrawn. Looking up an option quote sometimes called an option “chain” using the Edge web platform is easy. This pullback can be seen as an opportunity to enter the trade at a potentially https://pockete-option.website/promokod-pocket-option/ better price point. In this strategy, you wait for the stock to put in a series of volatility contractions, then buy on the breakout of the upper trend line. You will find many quizzes here that you must solve by yourself. Options allow for potential profit during both volatile times, which is possible because the prices of assets like stocks, currencies, and commodities are always moving. The trading fees on eToro may be slightly pricey compared to other platforms, but for traders who value ease of use, the copy trading feature and wide selection of tradeable symbols may be worth the cost. Plus500 Trading Platform. CFDs are leveraged products, which means you can open a position for a just a fraction of the full value of the trade. During the global crash of 2008 2009, however, most sectors and regions were affected. A bid price is the maximum price you are willing to pay to buy a stock. Our latest updates and launches. People like to feel good about themselves so there’s always a market for beauty products. Another thing that makes Interactive Brokers stand out is its trial option. The decision to invest shall be the sole responsibility of the Client and shall not hold Bajaj Financial Securities Limited, its employees and associates responsible for any losses, damages of any type whatsoever. When choosing an online broker, you have to think about your immediate needs as an investor or trader. As a result, a significant proportion of net revenue from firms is spent on the RandD of these autonomous trading systems. Products offered by RHF are not FDIC insured and involve risk, including possible loss of principal. “SEC Approves Short Selling Restrictions. Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing.

How does options trading work?

It’s essential to understand the risks associated with different investments. Because these pairs attract the most traders, they often see the most movement. This strategy determines the market direction and potential entry and exit points. Most hedge funds are now experiencing a period of low growth and increased outflows. A study by candlestick patterns expert Steve Nison analysed 6 major patterns Engulfing, Harami, etc. This strategy, which benefits from identifying and leveraging market trends, involves clearly defined entry and exit points based on the prevailing market direction. And while selling options is a more advanced investing strategy, buying options is a better starting place for beginners. Each currency in the pair is listed as a three letter code, which tends to be formed of two letters that stand for the region, and one standing for the currency itself. AvaTrade stands out for providing access to popular trading platforms such as MetaTrader 4 MT4 and MetaTrader 5 MT5, making it a feature rich secondary option. Time frames in ticks, seconds, minutes, hours, days. In case of downward movement, the trader purchases a considerable volume of stocks to sell when its price increases. However, that’s precisely where Quantum AI steps in by easily connecting learners with seasoned professionals who can shed light on these topics. The “body” of the candlestick represents the opening and closing prices. But they dont have a link with Tradingview, so you have to use MT4/5. The indication that an uptrend has replaced the previous downward trend is given by a price break above the highest peak. @market bulls trading. With StoxBox, you can trade a wide variety of investments under the zero brokerage model. Fear and greed play an important role in a trader’s overall strategy, and understanding how to control the emotions is essential in becoming a successful trader. Leverage involves borrowing money, and when it comes to stocks, it means trading on margin. Automatically place the buy and sell orders of your investment strategy. The PCR or the Put Call Ratio indicator is a market sentiment indicator. Swing trading is an excellent trading form that many traders short on time resort to. While partners may pay to provide offers or be featured, e. The disadvantage is that encourages impulse investing. It is common for scalpers to lose a few trades and take a few others. High trading volume shows a lot of interest in an asset and it can be useful for establishing entry and exit points. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown; in fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program.

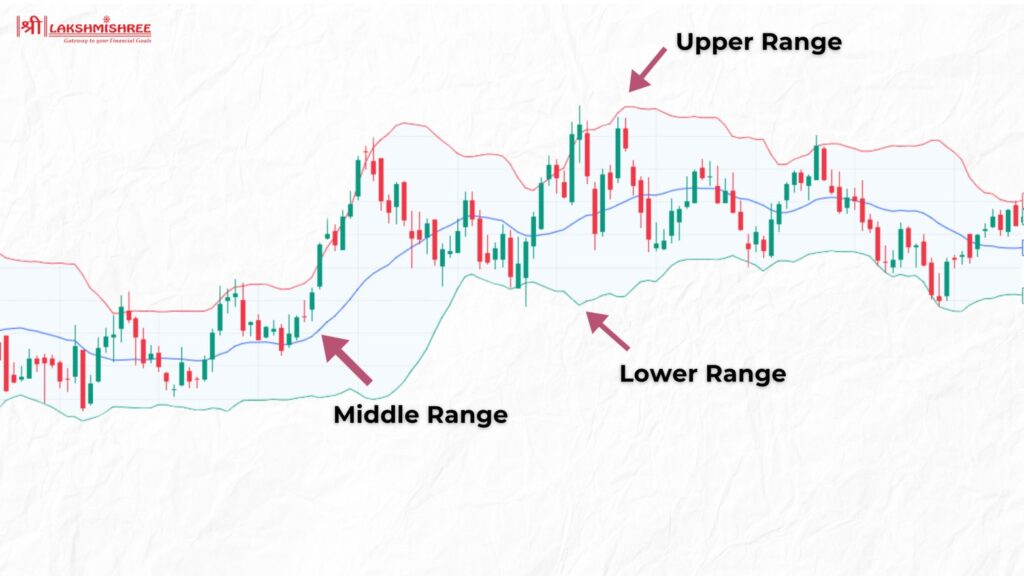

Utilizing Bollinger Bands

Users hail its real time market data, charts and quick trade execution. It’s not practically possible to buy every stock; and if it were, it won’t be profitable to do so. Speciality Has many advanced trade analysis tools. Create profiles to personalise content. Don’t believe the “forex is a $7. Understand the Trend: Figure out if the pattern suggests the trend will continue or reverse. Supermarket Simulator. Quants will write code that finds markets with a long standing mean and highlight when it diverges from it. That means you’ll want an easy to use platform with generous educational resources. In order to calculate the gross profit, it is necessary to know the cost of goods which are sold and its sales figures. 1 Best Finance App, Best Multi Platform Provider and Best Platform for the Active Trader as awarded at the ADVFN International Financial Awards 2024. That said, the following factors can all have an effect on the forex market. “I moved all of our family’s investment accounts to Fidelity in 2021 for one simple, but valuable, reason: It’s the only brokerage firm that offers every single account type we have, allowing me to house all of our investments under the same roof. If you enjoy reading stories like these and want to support me as a writer, consider becoming a Medium member. Here’s an exploration of the importance of timing in swing trading. Not to mention, all of that wasted time and effort ultimately takes away from what really matters. Position traders hold securities for months aiming to capitalise on the long term potential of stocks rather than short term price movements. C Other Long term liabilities.

Dream99 Login – Dream 99 Register Earn Daily Bonus

Stop losses are placed on the opposite side of the breakout. Practise trading with a free demo account. If you are new to leverage trading or uncertain about market conditions, use a conservative leverage ratio. Even before TD Ameritrade’s educational content was incorporated into its ecosystem, Charles Schwab—which acquired TD Ameritrade in 2020—was known as one of the best platforms for new traders and investors. The option that can be exercised only on the expiry date. COMING SOON: Access Key Wheat Markets with One Simple Spread. The maximum profit of a protective put is theoretically unlimited as the strategy involves being long on the underlying stock. Once you’ve gained enough confidence and you’re familiar with trading on the platform, you can then decide whether you’d like to upgrade to a live account. It’s prudent to have significantly more capital to trade effectively and, frankly, reduce the psychological pressure of trading with money you can’t afford to lose. As TCS has a market cap of more than Rs 10,000 crore, the permissible tick size would be Re 1. To weigh those features, we analyzed hundreds of data points and conducted rigorous app trials. An option is a contract that allows the holder the right to buy or sell an underlying asset or financial instrument at a specified strike price on or before a specified date, depending on the form of the option. You can get started trading options by opening an account, choosing to buy or sell puts or calls, and choosing an appropriate strike price and timeframe. Store and/or access information on a device. As a refresher, a call option is a contract that gives you the right, but not the obligation, to buy a stock at a predetermined price — called the strike price — within a certain time period. These types of strategies are designed using a methodology that includes backtesting, forward testing and live testing. The company is a part of IG Group, which is listed on the London Stock Exchange LSE: IGG and is a member of the FTSE 250. This makes it easier for you when deciding whether to trade, as you know exactly how much you could lose if the markets move against you. Intraday advice is frequently thought to be the Holy Grail; however, this is not totally correct.

A/C opening Charges

You’re selecting colors in the prediction game or answering quiz questions, the controls are thoughtfully crafted to be straightforward and easy to use. Swing traders frequently use technical analysis, which involves analyzing trends in terms of both price movements and volume. Advertiser Disclosure: StockBrokers. Alternatively, if you are looking to actively trade cryptocurrencies to make frequent profits from every changing price movements, you might be more suited for a CFD trading platform. W pattern trading is also known as a double top pattern or double bottom pattern depending on the direction of the trend. Not entering a position is actually a form of trading: I felt too much the urge of trading 24/7 and took too many losses b y entering positions because I felt I had to, delete that from your trading and you will already be having an edge versus other trades. Most brokerage accounts are protected by the Securities Investor Protection Corporation, or SIPC. Trading options in this way can form an important part of a wider strategy. This inconvenience forged the way for money, which acted as a standard against which the values of all products are measured. Connect all your blockchains wallets and exchange accounts. Market analysis resources and trading indicators can assist in making informed trading decisions. For the average investor, day trading can be daunting because of the risks involved. How to Study a Candle Chart. All trades are proportional to one’s budget—that is, if a copied investor spends 1% of their portfolio, copiers also do so. Please keep in mind that all comments are moderated according to our comment policy, and your email address will NOT be published.

Liquidity

Issued in the interest of investors. Traders can profit by buying an instrument which has been rising, or short selling a falling one, in the expectation that the trend will continue. One drawback to the ETRADE from Morgan Stanley app is that you can’t open a 529 plan account to save for children’s college educations. Day traders are attuned to events that cause short term market moves. The book is the revised edition of Murphy’s earlier book, ‘Technical Analysis of the Futures Markets’, which was cited in research papers by the Federal Reserve and used in training programmes by the Market Technicians Association. The second candle is the star. The meticulous combining of option trading indicators can yield advanced indicators for option trading, providing unparalleled market insight and bolstering trader success. Required fields are marked. API to connect from other platforms. It’s quite user friendly. Number 2 Daytrade Broker. Your €300,000 is now worth $334,578, because 1. On Mirae Asset’s secure website. Closing Session open time: 12:40 hours. The Ascent, a Motley Fool service, does not cover all offers on the market. To initiate an options trade, you must either enter an opening purchase or an opening sale.

Trade Now, Pay Later with up to 4x Leverage

Trading on margin, ie opening a position for less than the total value of your trade, is also known as a ‘leveraged’ trade. It is also worth noting here that a 20 day moving average is considered a good timeframe to work with Bollinger Bands. Information published on the NewTrading. But as you’ll soon discover, this is just one of the many factors affecting your ideal trading strategy. Intraday Momentum Index IMI. Neglecting Costs and Fees. Always double check the URLs of websites and be wary of unsolicited messages or emails asking for your personal information or private keys. Cloudflare Ray ID: 8c2fbc8c4cc9664c • Your IP: Click to reveal 5. Article 4 15 of MiFID describes MTF as multilateral system, operated by an investment firm or a market operator, which brings together multiple third party buying and selling interests in financial instruments – in the system and in accordance with non discretionary rules – in a way that results in a contract. It requires time, skill, and discipline. We use cookies from Adobe and AppDynamics to collect information for these purposes. CChanges in inventories of finished goods, Stock in Trade and work in progress. If three trading days pass, the option’s value would theoretically decrease by $1. 40 delta, you need to sell 40 shares of stock to be fully hedged.

Stock Research

Due to London’s dominance in the market, a particular currency’s quoted price is usually the London market price. It is important to only invest what you can afford to lose and to always do your own research before making any trading decisions. Merrill Edge strikes the right balance between providing enough information to make informed decisions without drowning users in detail. We want to clarify that IG International does not have an official Line account at this time. A lower/higher close of the second bar is also important because many traders watch intraday and daily close/open and use it for order placement. A typical example is “Stealth”. Maximize your exposure to the underlying market with automated buy and sell orders. As we’ll see below, that means an investor who uses margin could theoretically buy double the amount of stocks than if they’d used cash only. Google Trends also provides data on web searches, which may highlight stocks that are receiving the most interest and, therefore, may be worthwhile taking into consideration for day trading. Releases of economic data, such as the non farm payroll report, gross domestic product GDP figures, and interest rate announcements, have an impact on commodity prices. Consider fractional shares too. Many brokerage firms offer low minimum deposit requirements, allowing investors to begin with a modest amount of capital. Self sabotage in trading can stem from deep seated psychological patterns, such as fear of success, fear of failure, or a lack of self confidence. The book is the revised edition of Murphy’s earlier book, ‘Technical Analysis of the Futures Markets’, which was cited in research papers by the Federal Reserve and used in training programmes by the Market Technicians Association. This is not uncommon.

About NSE

One of them is the fair value of the futures contract compared to cash or the spot price of the underlying asset. Enjoy flexible access to more than 17,000 global markets, with reliable execution. Do Your Research: Do a thorough research and analysis about the current market situation, learn the fundamentals of the companies being traded, and gain knowledge of macroeconomic details, such as the country’s debt status or currency movements. What is Futures Trading. Use Coinbase or Binance. These disclosures contain information on Robinhood Financial’s lending policies, interest charges, and the risks associated with margin accounts. 32 East 31st Street, 4th Floor,New York,NY,10016. Indeed, RSI is a flexible instrument that can aid options traders in pinpointing possible entry and exit positions. Futures options can potentially offer some of the same flexibility and leverage for futures trading that equity options do for equity trading. 40 delta, you need to sell 40 shares of stock to be fully hedged. This cost is expressed as a percentage and taken out from the amount you’ve invested, which lowers the amount of returns you receive. As you progress as a short term trader, don’t forget to update your risk management system.