Any monies you owe to suppliers or other agencies for goods or services provided are placed under Accounts Payable. Accounts Payable is an expense account that lets you know how much money you owe to your creditors. Rent, business insurance, and software subscriptions are expenses you pay before receiving the benefit of the service—these are prepaid expenses. Single-entry bookkeeping is simpler — you only have to record each transaction once. This can be sufficient for very small businesses that aren’t incorporated. There are countless options out there for bookkeeping software that blends a good price with solid features and functionality.

- Or, you could fail to notice as your longer-term trajectory begins to run off course.

- Small businesses can do their own bookkeeping or outsource to professionals.

- But you can bet that those successful leaders invested in basic accounting training sooner or later for themselves and their leadership teams.

- It helps you estimate whether a given project or investment would result in more money coming in, or if you’d lose money on the venture.

- She holds a Masters Degree in Professional Accounting from the University of New South Wales.

This can be done using the traditional method or with activity-based costing. You can figure both your direct and indirect costs by performing a cost assignment to each type of good you produce or service you provide. The accrual method is a bit more difficult, in that your bank statements might not reflect the amounts on your income sheet.

What you need to set up small business bookkeeping

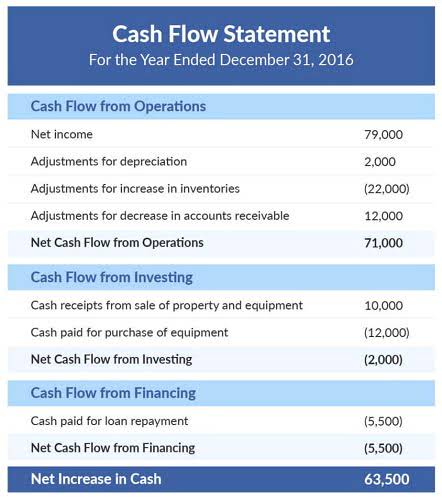

Bookkeeping is the system of recording, organizing, and tracking financial transactions and information for a business or organization. As you balance Accounts Receivable against Accounts Payable, the result is your net income. If the ratio of income to debt is small, you’re operating with a narrow profit margin. Analyze where you can cut some costs, and you can improve a narrow profit margin. You can also track your gross margin weekly, biweekly, or monthly based on your sales.

No matter your situation, here are some good choices to get you started. In order to follow the accounting equation, all entries made into your general ledger need to have a debit entry and a corresponding credit entry. Accounting software applications always include a default chart of accounts that you can use immediately. A good place to start is by reading The Ascent’s accounting tools reviews to get an idea of what’s available.

The Guide to Small Business Bookkeeping

If you’re using accrual, or double-entry accounting, you will need to understand the accounting equation and debits and credits, which are the backbone of any accounting system. Small business owners may also keep payroll in-house if they have just a few employees how to bookkeeping for small business and the capacity and skills to manage it. Accounts receivable (AR) is the money your customers owe you for products or services they bought but have not yet paid for. It’s important to track your AR to ensure you receive payment from your customers on time.