This means that it takes more accounting effort, and is also more prone to calculation errors. In addition, the result is unusually low asset carrying amounts, which can give the impression that a business is operating with a lower fixed asset investment than is really the case. This is usually when the net book value of the fixed asset is below the minimum value that asset is required to be capitalized (which should be stated in the fixed asset management policy of the company). Net book value is the carrying value of fixed assets after deducting the depreciated amount (or accumulated depreciation). It is the remaining book value of the fixed asset after it is used for a period of time. The net book value is calculated by deducting the accumulated depreciation from the cost of the fixed asset.

Differences Between Straight Line Method and Declining Balance Method

- The difference is that DDB will use a depreciation rate that is twice that (double) the rate used in standard declining depreciation.

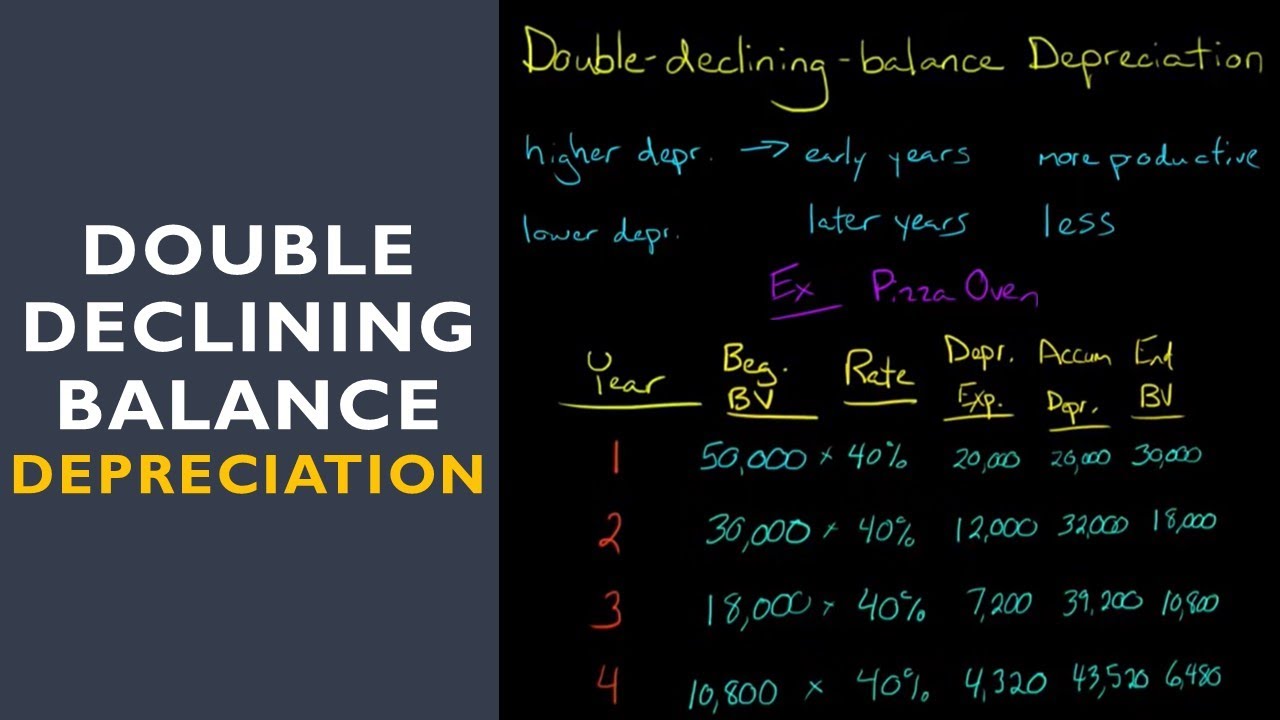

- The double declining balance method (DDB) describes an approach to accounting for the depreciation of fixed assets where the depreciation expense is greater in the initial years of the asset’s assumed useful life.

- When you’re a Pro, you’re able to pick up tax filing, consultation, and bookkeeping jobs on our platform while maintaining your flexibility.

- Its sale could portray a misleading picture of the company’s underlying health if the asset is still valuable.

These tools can automatically compute depreciation expenses, adjust rates, and maintain depreciation schedules, making them invaluable for businesses managing multiple depreciating assets. The DDB method contrasts sharply with the straight-line method, where the depreciation expense is evenly spread over the asset’s useful life. The choice between these methods depends on the nature of the asset and the company’s financial strategies. DDB is preferable for assets that lose their value quickly, while the straight-line method is more suited for assets with a steady rate of depreciation.

Terms Similar to the Declining Balance Method

The double declining balance method accelerates depreciation charges instead of allocating it evenly throughout the asset’s useful life. Proponents of this method argue that fixed assets have optimum functionality when they are brand new and a higher depreciation charge makes sense to match the fixed assets’ efficiency. Declining balance method of depreciation is an accelerated depreciation method in which the depreciation expense declines with age of the fixed asset.

What is the Double Declining Balance Method?

From year 1 to 3, ABC Limited has recognized accumulated depreciation of $9800.Since the Machinery has a residual value of $2500, depreciation expense is limited to $10000 ($12500-$2500). As such, the depreciation in year four will be $200 ($10000-$9800) rather than $1080, as computed above. Also, for Year 5, depreciation expense will be $0 as the assets are already fully depreciated. It doesn’t always use assets’ salvage value (or residual value) while computing the depreciation. However, depreciation ends once the estimated salvage value of the asset is reached. However, in those cases where the asset has no residual value, this method will never depreciate the asset fully and is typically changed to the Straight Line Depreciation Method at some stage during the asset’s life.

You can connect with a licensed CPA or EA who can file your business tax returns. Get started with Taxfyle today, and see how filing taxes can be simplified. Set your business up for success with our free small business tax calculator. Free up time in your firm all year by contracting monthly bookkeeping tasks to our platform.

Step 2: Compute Current Year Depreciation Expense

No actual cash is put aside, the accumulated depreciation account simply reflects that funds will be needed in the future to replace the fixed assets which are reducing in value due to wear and tear. Each year the declining balance depreciation rate is applied to the opening net book value of the asset. At the end of 4 years the net book value is 1,296 which equals the salvage value of the asset. With the constant double depreciation rate and a successively lower depreciation base, charges calculated with this method continually drop.

By dividing the $4 million depreciation expense by the purchase cost, the implied depreciation rate is 18.0% per year. If you want to learn more about fixed asset accounting as a whole, then head to our guide on what fixed asset accounting is, where we discuss the four important things you need to know. Also, if you want to know the other essential bookkeeping tasks aside from fixed asset accounting, you can read our piece on what bookkeeping is and what a bookkeeper does. The diagram below shows the analysis by year of the declining method depreciation expense. The rate would normally be 2 – 3 times the straight line depreciation rate. For the first period, the book value equals cost and for subsequent periods, it equals the difference between cost and accumulated depreciation.

Likewise, the depreciation rate in declining balance depreciation will be 40% (20% x 2). The declining balance method is one of the two accelerated depreciation methods and it uses a depreciation rate that is some multiple of the straight-line method rate. The double-declining balance (DDB) method is a type of declining balance method that instead uses double the normal depreciation rate. However, the company needs to use the salvage value in order to limit the total depreciation the company charges to the income statements. In other words, the depreciation in the declining balance method will stop when the net book value of the fixed asset equals the salvage value.

It’s most useful where an asset’s value lies in the number of units it produces or in how much it’s used, rather than in its lifespan. The formula determines the expense for the accounting period multiplied by the number of units produced. The straight-line depreciation method simply subtracts the salvage value from the cost of the asset and this is then divided by the useful life of the asset. The annual straight-line depreciation expense would be $2,000 ($15,000 minus $5,000 divided by five) if a company shells out $15,000 for a truck with a $5,000 salvage value and a useful life of five years. Salvage value is the estimated resale value of an asset at the end of its useful life. Book value is the original cost of the asset minus accumulated depreciation.

Depreciation calculations determine the portion of an asset’s cost that can be deducted in a given year. Or, it may be larger in earlier years and decline annually over the life of the asset. what is an accounting ledger sage advice us When large amounts of depreciation are being recognized early in the life of an asset, this means that the carrying amount of the asset is severely reduced within a short period of time.