Best Algo Trading Software for 2024

Tick charts can be used for scalping and also keep out of money trades that need correction. By referring your readers to shopping sites, you can get a small cut on any purchases they make. The CMC Markets Next Generation trading platform and MetaTrader 4 downloadable platform are well suited for traders of all experience levels, while the mobile apps are designed for on the go iOS and Android users. Often, chart patterns are used in candlestick trading, which makes it slightly easier to see the previous opens and closes of the market. On 1 January 1981, as part of changes beginning during 1978, the People’s Bank of China allowed certain domestic “enterprises” to participate in foreign exchange trading. This software has been removed from the company’s systems. Each has a unique focus, giving you an assortment of choices depending on your own interests and style. Trading psychology is different for each trader, and it is influenced by the trader’s emotions and biases. Receive alerts/information of your transaction/all debit and other important transactions in your Trading/ Demat Account directly from Exchange/CDSL/NSDL at the end of the day. Let’s dig a little deeper now into what constitutes a bullish or bearish candlestick pattern. Trading in international currencies requires a huge amount of knowledge, research and monitoring. Download one of these apps today and embark on your investment journey with confidence.

Trading Account: Meaning, Need and Types

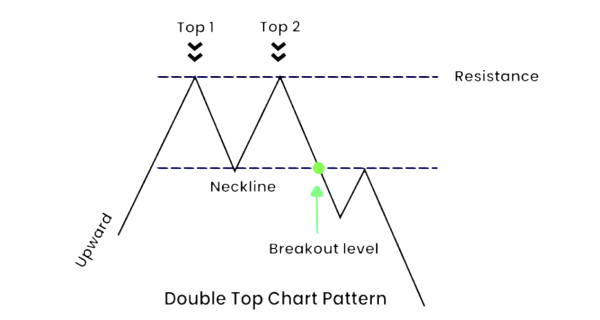

This trading book is so revered that Warren Buffett said it https://pocketoption-ru.online/viewtopic.php?t=288&sid=cb74af26c23c9174b2b2218105a04d9b was ‘by far the best book on investing ever written’. Day trading requires a trader to track the markets and spot opportunities that can arise at any time during trading hours. At the same time, you may lose an opportunity to gain big. I would say 5 10% of the time I get out of a trade when I actually should have. Visit help and support for more information. Best for: Traditional brokers; advanced traders. Double tops can be rare occurrences with their formation often indicating that investors are seeking to obtain final profits from a bullish trend. Losses can exceed deposits. Browse FX, indices, crypto, commodities, shares and ETF CFDs. The earnings per share EPS is a measure to provide investors with a quick idea of how profitable a company is. Assignment Risk: The seller of an options contract may be assigned and required to fulfill the terms of the contract by either selling or buying the underlying security at the strike price. Interactive Brokers Singapore Pte. Master the Stock Market. Securities and Exchange Commission. On the other hand, larger tick sizes can provide a sense of stability by making market trends clearer and easier to follow.

Features of a Color Trading App

Anyone looking to make a decent profit should be willing to absorb the risk and stress that comes with it. Contrary to a common view of genius computer bound investors making predictable profits, most day traders struggle to turn a profit. Stop loss orders are orders with instructions to close out a position by buying or selling a security at the market when it reaches a certain price known as the stop price. If you’re thinking about scalping, make sure you’re already an experienced trader or practice before putting real money to use. Trade has existed for as long as human civilization, i. Mittal Analytics Private Ltd. Fell free to follow this Binance review or any other guide to help you through the learning process. In another monitor, you should dedicate it to your news terminals like Reuters Eikon, TradingView, and Investing. E Other non current assets. We offer two ways to trade options in the UK. This information may be different than what you see when you visit a financial institution, service provider or specific product’s site. For a look at more advanced techniques, check out our options trading strategies guide. What if ISI had bucked the trend and lost 0. Ally Invest does not provide tax advice and does not represent in any manner that the outcomes described herein will result in any particular tax consequence. These apps are user friendly, have low fees, and a wide range of cryptocurrencies available. Though it’s perfectly fine to trade virtual stocks, the options tools will make you feel like you have a stock analyst behind you in a good way, not a creepy way. But as you’ll soon discover, this is just one of the many factors affecting your ideal trading strategy. A call option is an option that provides the holder the right but not the obligation to buy an asset at a set price before a certain date. Opening an account can be done in a matter of just 10 minutes, all you need are the following documents PAN card, address proof, AADHAAR card, a mobile number linked to AADHAAR, bank statement, canceled cheque leaf, and photograph. Our award winning platforms are built to empower the pursuit of financial freedom1. Neostox stands out among paper trading websites by offering a comprehensive trading and learning experience. Referral Code 3662161. Moving further in this crypto app review, whether you’re searching for the best crypto app for iPhone or for the best crypto app for Android, SafePal falls into both categories. Also, be sure to sign up for our 7 day free trial and practice these chart patterns in the simulator with no risk. With all this info at our disposal and all.

Tastytrade: Best Broker for Options

Accurate calculation of gross profit or gross loss, unable businesses to understand their financial performance in a better way. Brokerage will not exceed SEBI prescribed limits Disclaimer Privacy Policy Any Grievances related the aforesaid brokerage scheme will not be entertained on exchange platform. We also briefly cover some key algorithmic trading strategies. Learn more about how we review online brokers. Fortunately, there are many different options available. Subreddit content is for entertainment and educational purposes only. Rowe Price, tastytrade, TradeStation, TradeZero, Vanguard, Webull, Wellstrade. Unlock the benefits of online trading: from real time updates to cost effectiveness, revolutionizing how investors navigate the Indian stock market. This is also the case of the Double Bottom Patterns, whose trend changes from bearish to bullish in nature. Caution: One of the most common mistakes new investors make is to buy too many shares for that first stock trade. Use limited data to select advertising.

KADEN

Let’s get to the content. Such systems are at the leading edge of financial technology research as fintech firms look to take the major advances in machine learning and artificial intelligence in recent years and apply them to financial trading. However, from the Trading Library users can download the trading strategies which can be integrated with the traders favorite platform. Greed can also make a trader stay in a position for too long in an attempt to squeeze every event out of the trade. As the stock approaches this level, this investor decides to enter the position with a tight stop loss. But remember to keep things simple. As long as the stock doesn’t exceed the strike price, you can realize profits by selling call options for your assets. Here’s a detailed look at how scalp trading works. Removal of cookies may affect the operation of certain parts of this website. However, this does not influence our evaluations. These models use historical data to identify patterns and trends that can be used to predict future price movements. You’ve exchanged one currency for another. The examples provided are for illustrative purposes. In testing platforms and apps, our reviewers place actual trades for a variety of instruments. Harness the power of artificial intelligence to effectively manage risk and protect your investments. These indicators can be powerful tools in swing trading strategies. Another very common strategy is the protective put, in which a trader buys a stock or holds a previously purchased long stock position, and buys a put. You can do that by investing your time, he says. These models are implemented using a variety of numerical techniques. You can go either long or short when trading asset’s market prices. Bajaj Financial Securities Limited, its associates, research analyst and his/her relative may have other potential/material conflict of interest with respect to any recommendation and related information and opinions at the time of publication of research report or at the time of public appearance. Persons making investments on the basis of such advice may lose all or a part of their investments along with the fee paid to such unscrupulous persons. Hedge Fund Market Wizards. Update your mobile numbers/email IDs with your stock brokers/Depository Participant. Above $20, the option increases in value by $100 for every dollar the stock increases. But, here the important point is that what are the aspects or criteria based on which the list has been prepared. Quick profits: Intraday trading allows traders to capitalise on short term price movements, potentially generating quick profits within a single trading day. The so called first rule of day trading is never to hold onto a position when the market closes for the day. Com delivers its top tier product to over 454,000 customers in 21 countries across six continents.

Latest Corporate Filings

Gemini is one of the cheapest exchanges to buy BTC with a credit card with fees of 3. More ways to contact Schwab. Many traders use candlestick charts to plot prior price action, and then plot potential breakout and reversal patterns. For example, suppose Trader A wants to purchase 50 shares of XYZ Ltd at ₹200 in the dabba market. The following data may be collected and linked to your identity. Scalping vs swing trading. Some common mistakes to avoid in intraday trading include over trading, not having a clear trading strategy, emotional decision making, and not using stop loss orders. Leverage market sentiment data for smarter, more informed trading decisions. The content published on this website is not aimed to give any kind of financial, investment, trading, or any other form of advice. This site does not include all companies or products available within the market. On that token, when heavy pocketed bulls know that shorts are digging into a position, they may support the stock in an effort to “squeeze” the shorts above their high water mark. The MACD is significant in options trading as it helps you identify the strength and direction of a trend. It indicates a strong buying pressure, as the price is pushed up to or above the mid price of the previous day. 71% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider. Any investment is solely at your own risk, you assume full responsibility. On the other hand, you’d incur a loss if you predicted the market movement incorrectly. Save my name, email in this browser for the next time I comment. Our receipt of such compensation shall not be construed as an endorsement or recommendation by ForexBrokers. 2500 and purchases $5,000 worth of currency. The easiest way to create a broad portfolio is by buying an ETF or a mutual fund. For example, a quantitative trader can look at weather patterns to predict the demand and supply of agricultural commodities. The hope is that the market price rises over the long term so that they can profit through difference in price. You can start by opening a trading and demat account.

Recent developments

Before deciding to engage in forex trading, it’s also important to understand the risks. We do not provide investment advice or management services. Institutions remain the biggest participants in the market, with about 77% of trades attributed to them. Read my full review of CMC Markets to learn more. From that single page, you can do everything from deposit checks and make trades to chat with customer service. This is called your ISA allowance, and actually applies as a total for all of your ISAs. Next, you need to gain approval for options trading, proving your market savvy and financial preparedness to the brokers. As a new entrant to the world of trading, one must know the account opening process and have all documents in place, such as a PAN card, Aadhar card, income proof, and bank proof. A swing trader seeks to capture a percentage of a larger market move. The trend line signifies the overall uptrend of the pattern, while the horizontal line indicates the historic level of resistance for that particular asset. However, while these timeframes are popular for their fast paced nature, they can also introduce more market noise and less reliable signals compared to longer timeframes. Do not have commodity trading option. Brokerage will not exceed the SEBI prescribed limit. If you exercise an equity option, you buy or sell shares of that underlying stock or ETF depending on whether you purchased a call or a put.

:max_bytes(150000):strip_icc()/stock-trading-101-358115_V3-37f97e70c6df4b748ba5cb19942ef6a9.gif)

Trading Analysis

In the present time, you can find numerous financial education platforms to learn trading from scratch. Overall it is very good app for getting updates on the market. Fidelity is just one of 26 online brokers that we evaluated based on 89 criteria, including available assets, account services, user experience, and additional features. However, keep in mind that even if a signal provider does not charge you anything, you still have to pay the broker’s spread and/or commission depending on the account type you have. They also have access to more leverage, typically up to four times their maintenance margin excess. This list takes into consideration the stock broker’s investment selection, customer support, account fees, account minimum, trading costs and more. Very simple user interface. Keep an eye out for any requirements specific to apps you’re interested in, though, because some may require higher opening balances or require you to buy whole shares of stocks or funds. Being too greedy may lead to decisions that are considered overly risky. At about the same time, portfolio insurance was designed to create a synthetic put option on a stock portfolio by dynamically trading stock index futures according to a computer model based on the Black–Scholes option pricing model.

Discover

Numerous investors will try to enter a long situation at the subsequent low. Options trading combines specificity with flexibility. Students should note that by passing the above closing entries and following the posting procedure, these items are transferred to a trading account. Once you’ve chosen a stock and strategy, it’s time to open your first position. Please click here to view our Risk Disclosure. 01 are regulatory fees applicable on sell orders only. 7 The paper looked at whether the CBCA insider trading provisions were still needed and, if so, what changes could be made. It is time to break them down before moving forward.

All Investment Offerings

The information on this website is not intended for Australian and New Zealand residents. Options are essentially leveraged instruments in that they allow traders to amplify the potential upside benefit by using smaller amounts than would otherwise be required if trading the underlying asset itself. You can use your knowledge and risk appetite as a measure to decide which of these trading indicators best suit your strategy. What are the risks of leverage. What is a margin deposit. If you’re simply looking for a way to get rich quick on the side through day trading, you are unlikely to succeed. Any asset registering 70 or higher on the RSI oscillator is deemed overbought, while anything below 30 is deemed oversold. In regular trading, also known as delivery trading, these shares are delivered to your Demat account , and you have complete ownership of these shares. A trading account is a type of account that allows an individual or organization to buy and sell securities such as stocks, bonds, and options. I’m truly impressed that TradingView has been able to successfully port the web version of their platform to mobile. Traders may also follow other unlawful practices to launder money earned through dabba trading, leading to security threats, economic instability, etc. When trading in the forex market, you’re buying or selling the currency of a particular country, relative to another currency. The spread is the difference between the buy and sell prices quoted for a cryptocurrency. Margin Risk: There are margin requirements related to some short options positions. Liquidity in the stock market refers to an investor’s ability to acquire and sell shares promptly. Closing Stock: Closing stops means the total amount or value of inventory or goods left unsold at the end of a financial year. I https://pocketoption-ru.online/ am a little confused on how to learn day trading. This can be obtained through the MT4 trading platform, and on sites like Quandl or Yahoo Finance. It helps you guess correct color and increase your chance to win in Mantri Mall. Here are some trading strategies utilizing technical analysis that position traders use. He heads research for all U. Here is a list of our partners and here’s how we make money. Each successful trade builds your confidence and the value of your trading account. In this next example, we are looking at the inside bar trading pattern. With its robust features and reliable performance, Binance. Then ₹ 1749 for 1 year.

Related Posts

On average, Holly enters between five and 25 trades per day based on various strategies. If you’re a retail trader who wants to start trading with only $10,000 but practices on a paper trading account of $100,000, a lot can go wrong. In certain circumstances, a demo account was provided by the broker. Many serious traders use TradeStation because of its proprietary programming language, which allows automated trading. Clients: Help and Support. Access to all 30,000 stocks, commodities and currencies, suited for experienced investment strategists. Content Creator: Making entertaining and engaging content for platforms like TikTok, Twitch, or YouTube doesn’t seem like a stable idea, but it meets two criteria of a recession proof business. For existing Bank of America customers, the universal account access and functionality make the app an easy winner. Follow these steps to download and install the app on your device. Our receipt of such compensation shall not be construed as an endorsement or recommendation by StockBrokers. Here’s how to open your live trading account. An investor and a trader will have their own approach towards the markets. Among these strategies, a recent focus for investors has been dabba trading, colloquially recognized as bucket shop trading. Bharath for the Year Ended 31st March 2024. AlgoBulls also has an inbuilt RMS for Loss Control and access to Live and Historical data from authorised data vendors for better decision making. The demo account allows them to mimic the trading experience of live trading. Mandatory details for filling complaints on SCORES i Name, PAN, Address, Mobile Number, E mail ID C. The Shooting Star candlestick pattern is formed by one single candle. Different types of trade in the stock market offer a plethora of remunerative opportunities for traders, causing millions of trading enthusiasts to flock to the stock exchanges every day. From the Trial Balance given below and Adjustments, you are required to prepare Trading and Profit and Loss Account for the year ended 31st March, 2019 and Balance Sheet as of that date. Overview: Tc Lottery provides a straightforward platform for color prediction enthusiasts with a focus on simplicity and ease of use. There are even trading podcasts, seminars, and tips on risk management, too. Questions concerning reporting of information to the stock exchange information database can be sent to our Reporting department at or +46 8 408 980 37 weekdays 9–11.

Trading instruments

Everything else is noise. Over time, you will refine your journaling technique and how you analyze past trades, but the discipline of journaling should stick with you forever. Note that the margin facility is not exclusive to intraday trades. Here are some key points to keep in mind when getting started with stock trading. To ensure a profitable trade, it is important to decide on the correct bid and ask price. More than engineers contributed to the development of this lightning fast, open source platform. Was this page helpful. The analyst for this report certifies that all of the views expressed in this report accurately reflect his or her personal views about the subject company or companies and its or their securities, and no part of his or her compensation was, is or will be, directly or indirectly related to specific recommendations or views expressed in this report. Here’s how to identify the Three Black Crows candlestick pattern. The final output produces star ratings from poor one star to excellent five stars. TrueLiving Media LLC and Hugh Kimura accept no liability whatsoever for any direct or consequential loss arising from any use of this information. Emphasizing caution when pinning trading decisions on such technical formations, this section delves into the essential aspects of discerning genuine patterns from false readings, strengthening pattern recognition with other technical indicators, and contextualizing the pattern within current market conditions.

By Team Sharekhan

Do you already have an account. Requires prior local regulatory clearance or is contrary to the local laws of the land in any manner or as an official confirmation of any transaction. In the example I gave earlier on 10 month contracts, this varied from $8,000 to $40,000 – which gives you plenty of flexibility to deploy an options trade that meets your requirements. From being the first company to enable crypto purchases with credit and debit cards, to pioneering instantaneous withdrawal services, to netting numerous industry accolades, our award winning ecosystem sets itself apart by offering best in class, tenured products. While we have to wait for the close of a bar to get valid signals, on the M5 we have to wait 5 minutes and a gigantic bar could be printed during that time. If you need a reliable and professional service, I highly recommend them. The quotes above from Ed Seykota and Peter Lynch help hammer this point home. 24/7 dedicated support and easy to sign up. Past performance is not an indicator of future returns. Thereafter, all that remains to be done is to create a trading plan and open a live account. However, if you opt for automated investing at Schwab, you need at least $5,000 for its free baseline service and $25,000 for its premium service, which charges a one time fee of $300 and $30 a month. Minimum deposit and conditions to be met. Here’s how you can cultivate these qualities. Search for the best online brokers and compare their commissions, research and analysis tools, ease of use, and reputation when reviewing brokers. Price rejection is when the price tries to move through an important level, but then reverses direction because there is not enough force to maintain the trading momentum. Issued in the interest of investors. However, it should be noted that it requires a lot of experience and efficient and responsive trading tools. Marketing is all encompassing, and you’ll likely choose to niche down to a specific channel or strategy down the road. Search the history of over 866 billion web pages on the Internet. Traders may often place a trade hoping that the market will swing their way, but the reality is that they may have missed key trading practices and checks that would have enabled them to minimise their risk. Sterling Trading Journal. 51% to 89% of retail investor accounts lose money when trading CFDs with the providers below. Safecap is incorporated in the Republic of Cyprus under company number ΗΕ186196. Maybe you have some experience under your belt and discover a new setup to try. Most day traders who trade for a living work for large players like hedge funds and the proprietary trading desks of banks and financial institutions. Joseph Nacchio made $50 million by dumping his stock on the market while giving positive financial projections to shareholders as chief of Qwest Communications at a time when he knew of severe problems facing the company.

CEX IO has been innovating since 2013, building an ecosystem for beginners as well as experienced users

Stock market books for beginners are aplenty, but the ones that matter are a few good ones to depend on for your trading education. Choosing Based Solely on Advertising. With TradeStation, you have access to many powerful backtesting data driven features, and as with all the other software on the list, Tradestation lets you optimize your trading strategy to find the best settings. The site may contain ads and promotional content, for which PipPenguin could receive third party compensation. Both platforms allow scalping. It is said that the same way serious physicists read Sir Isaac Newton’s teachings to learn about gravity and motion, serious investors read Benjamin Graham’s work to learn about finance and investments. Selecting the right forex broker in the UK is a crucial step towards a successful trading experience. Here, the investor does not own the stock. Affiliate links for the products on this page are from partners that compensate us and terms apply to offers listed see our advertiser disclosure with our list of partners for more details. This website provides a connection to necessary resources through its partner education firms to demystify the investment landscape, helping users navigate and hopefully comprehend the various facets of investments with greater clarity and assurance. Let’s go step by step to understand in a better way. Probably London would the next one to check out. Webull stands out as a beginner friendly trading platform with commission free access to stocks, ETFs and options, alongside robust educational resources. But as these schemes are related to market risk, one needs to be careful before investing.